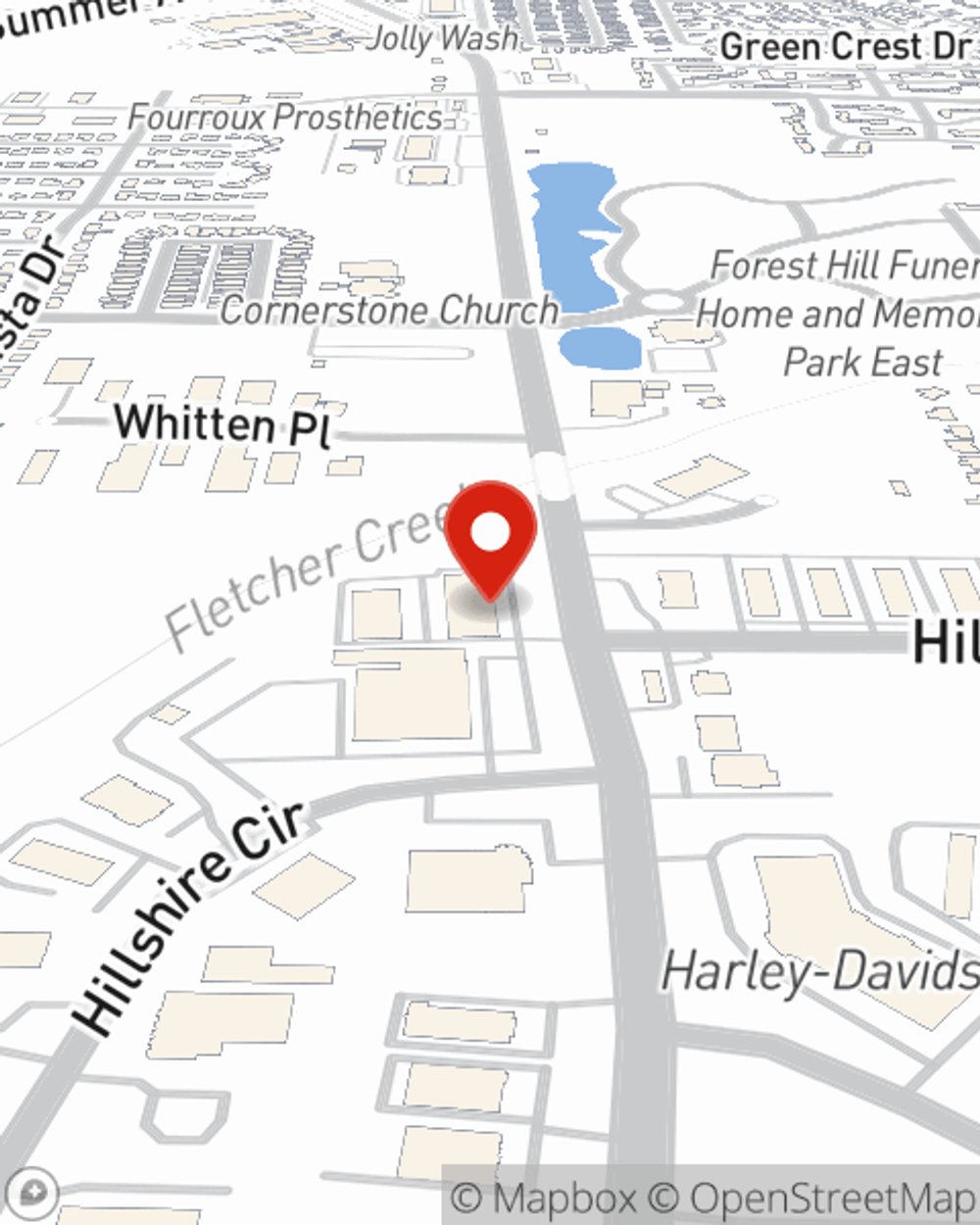

Business Insurance in and around Memphis

Researching insurance for your business? Look no further than State Farm agent Shantorra Owens!

Almost 100 years of helping small businesses

- Memphis

- Cordova

- Bartlett

- Raleigh

- Desoto County

- Marshall County

- Walls County

- West Memphis

- Arkansas

- Arlington

- Southaven

- Collierville

- Germantown

- East Memphis

- Millington

- Wolfchase

- Countrywood

- Olive Branch

- Lakeland

- Oakville

- Lenox

- Horn Lake

Cost Effective Insurance For Your Business.

Running a small business comes with a unique set of highs and lows. You shouldn't have to deal with those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including extra liability coverage, business continuity plans and worker's compensation for your employees, among others.

Researching insurance for your business? Look no further than State Farm agent Shantorra Owens!

Almost 100 years of helping small businesses

Small Business Insurance You Can Count On

Whether you own a HVAC company, a lawn care service or a barber shop, State Farm is here to help. Aside from exceptional service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Get right down to business by calling or emailing agent Shantorra Owens's team to learn more about your options.

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Shantorra Owens

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".