Renters Insurance in and around Memphis

Looking for renters insurance in Memphis?

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Memphis

- Cordova

- Bartlett

- Raleigh

- Desoto County

- Marshall County

- Walls County

- West Memphis

- Arkansas

- Arlington

- Southaven

- Collierville

- Germantown

- East Memphis

- Millington

- Wolfchase

- Countrywood

- Olive Branch

- Lakeland

- Oakville

- Lenox

- Horn Lake

Home Sweet Home Starts With State Farm

It may feel like a lot to think through keeping up with friends, work, family events, as well as coverage options and savings options for renters insurance. State Farm offers no-nonsense assistance and unmatched coverage for your souvenirs, clothing and pictures in your rented home. When mishaps occur, State Farm can help.

Looking for renters insurance in Memphis?

Renting a home? Insure what you own.

Open The Door To Renters Insurance With State Farm

You may be wondering if Renters insurance can actually help protect you, but what many renters don't know is that your landlord's insurance generally only covers the structure of the apartment. What would happen if you had to replace your valuables can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when fires or break-ins occur.

If you're looking for a committed provider that can help you understand your options, call or email State Farm agent Shantorra Owens today.

Have More Questions About Renters Insurance?

Call Shantorra at (901) 377-0099 or visit our FAQ page.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

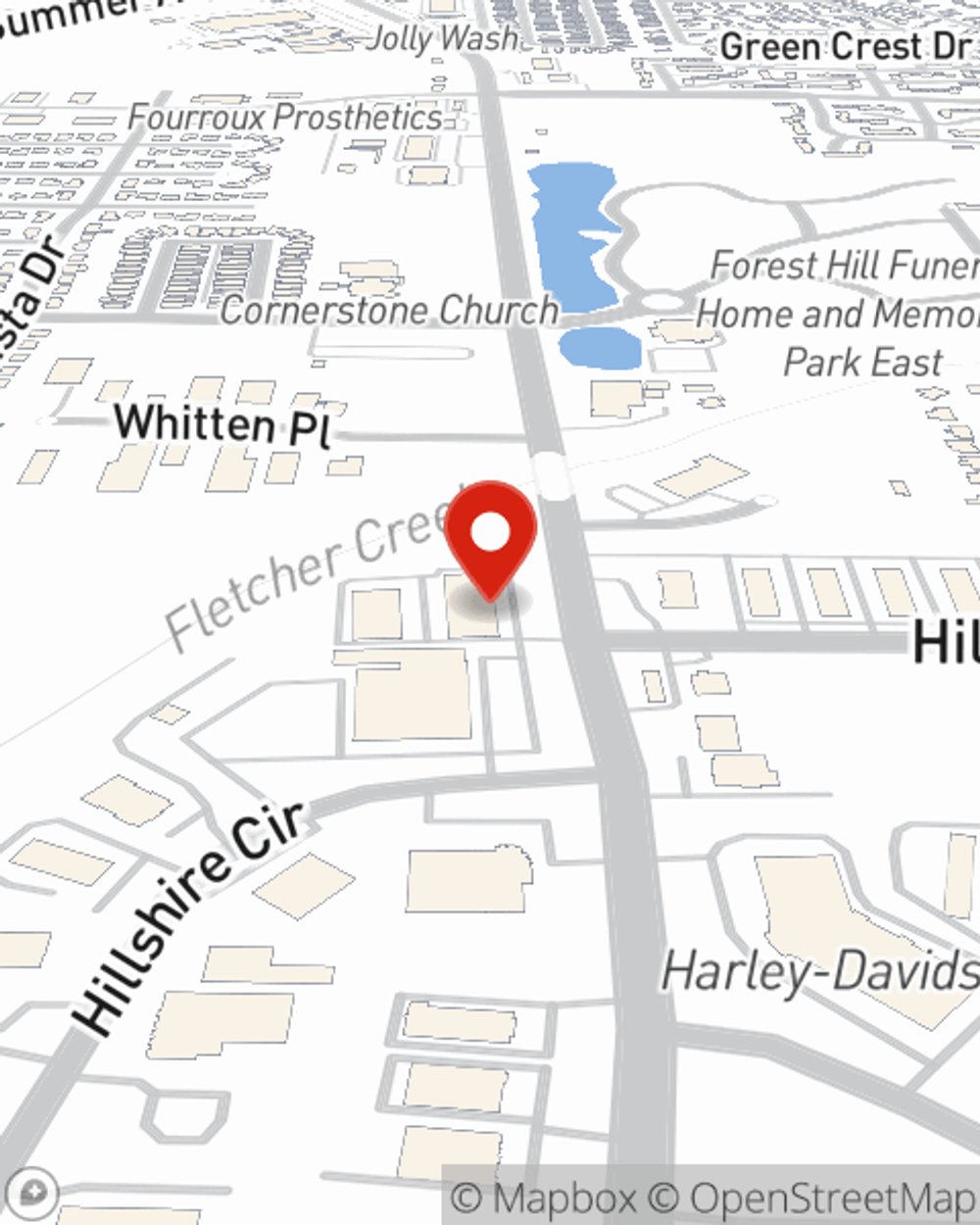

Shantorra Owens

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.